POINT: South Dakota sports betting — an untapped resource

Guest column by Garrett Gross, Dakota Gaming Group president & co-founder

On Sunday, tens of millions of dollars will be wagered on Super Bowl LVII in South Dakota. Unfortunately, about 99 percent will be wagered illegally, or South Dakota residents will cross state lines into Iowa, Wyoming and North Dakota.

In November 2020, voters passed Amendment B by a 58 percent YES vote to “...allow sports betting within the city limits of Deadwood.” Then in September 2021, the South Dakota Commission on Gaming began allowing retail-walk-up sports betting only within the physical boundaries of the brick-and-mortar casinos in Deadwood.

Over the past 16 months, approximately $10 million has been wagered in Deadwood, yielding about $80 thousand in taxes. In comparison to Iowa, in just December 2022 alone, $230 million was wagered with $1.3 million collected in taxes. In Wyoming, for December 2022, $15 million was wagered with $135 thousand in taxes generated for that month alone.

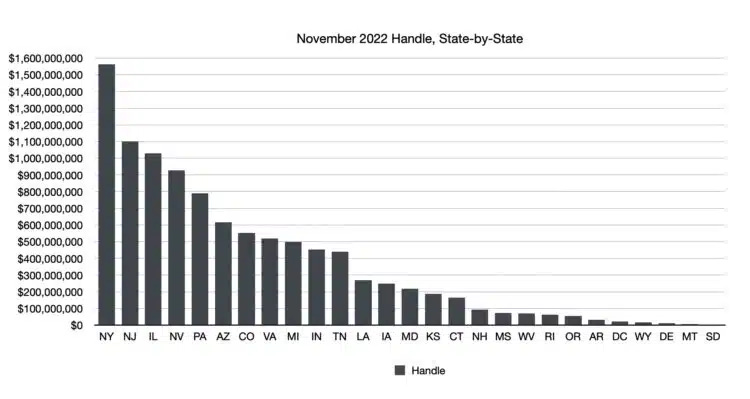

To say sports betting in South Dakota has been a success, simply is not true. The approximately $80 thousand in taxes generated the past 15 months might pay the annual salary of a single state employee. There are literally millions in tax dollars being left on the table based on the current system. There are now more than 30 states that allow sports betting, and South Dakota is in last place for Handle, Hold and Taxes Generated. This remains true per capita, or any adjusted measure examined, and it is not close. With the current model in South Dakota, only the illegal operators and neighboring states are the winners. They avoid taxes and siphon off tax dollars from the state.

COUNTERPOINT: Expanding sports gaming a bad bet for South Dakota

Keep reading with a 7-day free trial

Subscribe to The Dakota Scout to keep reading this post and get 7 days of free access to the full post archives.