Are city food tax revenues on the chopping block in South Dakota?

Opponents of repeal effort say conflict between ballot measure and existing state law have local governments in peril

The language of a ballot question proposing a repeal of the state’s sales tax on food stipulates the measure wouldn’t apply to South Dakota’s towns and cities.

But opponents of Initiated Measure 28 say the ability of municipalities to continue collecting a 2 percent tax on groceries — and potentially non-food items consumed by humans — isn’t that simple and could jeopardize the revenue source heavily relied upon by small communities.

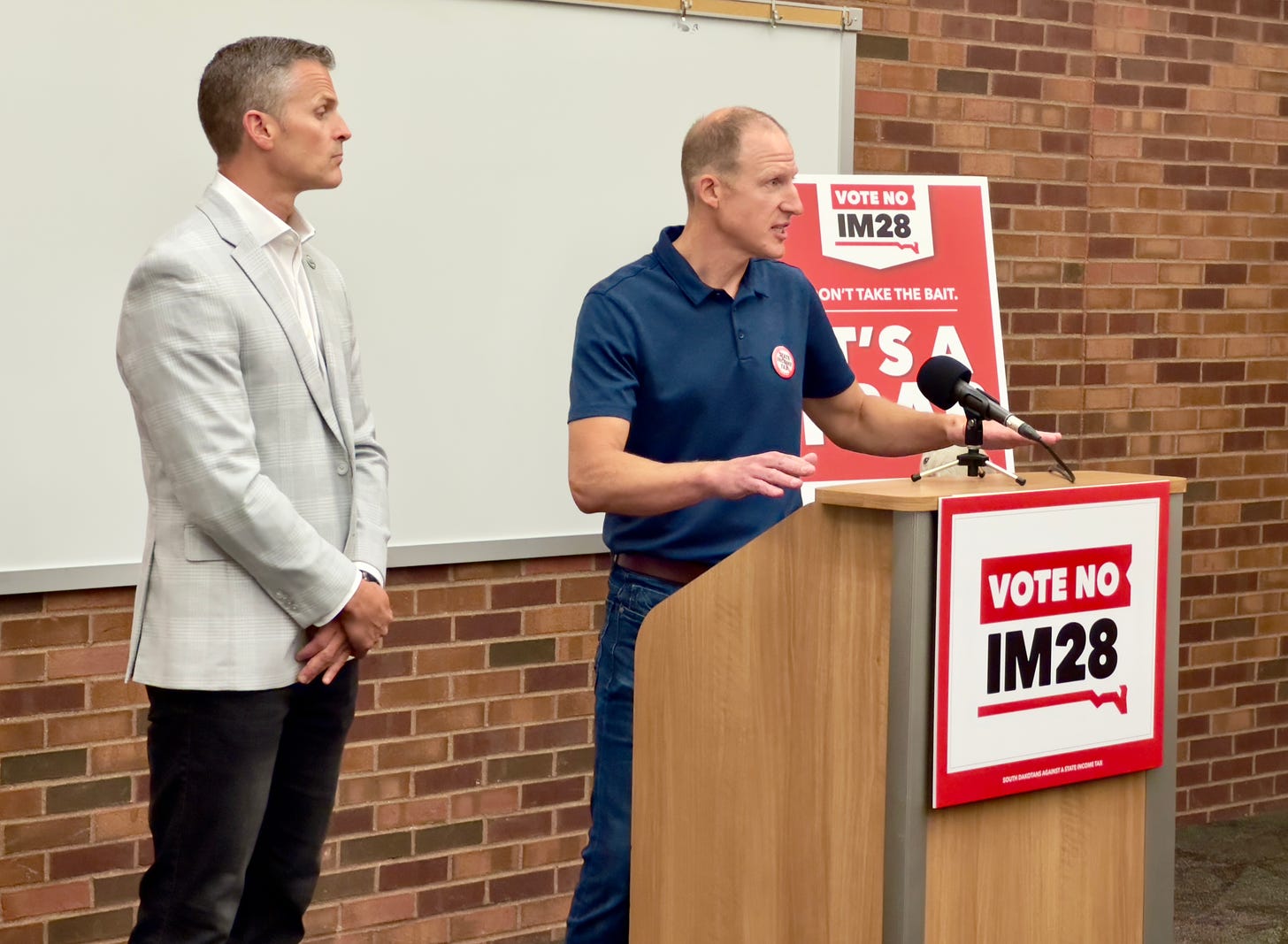

That’s the case Mayor Paul TenHaken and other members of a newly-formed coalition of industry groups opposed to IM 28 made during a morning news conference Tuesday, citing existing state tax law that would remain on the books even if a food tax repeal is approved by voters.

NEWS: Agreement between feds and state could keep more tribal officers close to home

Keep reading with a 7-day free trial

Subscribe to The Dakota Scout to keep reading this post and get 7 days of free access to the full post archives.